ONE of the top financial concerns of retirees is running out of money.

Whether you were an executive earning a reasonable income, or if you are making top dollars as a businessman, the fear is still valid.

For example, Tommy, who left the working world soon after selling his factory to a European multinational corporation. Tommy shared during one of our meetings that he was golfing every week and globe trotting almost every other month.

However, there was a problem that greatly bothered him. He found that he was dipping into his fixed deposit every now and then just to maintain his interesting lifestyle.

“Yap, you will never understand how bad the feeling is when you have to break your fixed deposit to cover your living expenses, ” he said.Combing through all of his finances, we discovered that Tommy’s lackadaisical attitude was to be blamed. He has not been paying enough attention to invest and generate income from the RM12mil nest egg that he had painstakingly accumulated. His investment portfolio was a mess.

Over the years, he invested in a few properties but never really bothered to oversee them. When tenants left, he didn’t make an effort to secure new tenants. In fact, some properties were even sitting vacant and idle. His excuse? He was too busy running the business.

Tommy has also invested in some shares and unit trusts but he seldom monitors and reviews their performances. Imagine his surprise when he went looking for some extra cash but discovered that most of the investments were not making money. Prior to meeting me, he couldn’t decide whether to sell or to keep those underperforming investments.

Consequently, the bulk of Tommy’s wealth is in fixed deposit. The trouble is the interest income from fixed deposit barely covers the impact of inflation. As such, if Tommy continues to spend on his interest income, he will risk having the principal depleted.

Asset rich, income poor

Tommy’s problem is a typical case of “Asset Rich, Income Poor.” His situation is definitely not unique. In fact, I find most self-made millionaires or business owners, typically strong at creating wealth from their business or professional career, but poor at generating income and gain from the created wealth.

For one, all the time spent ensuring their businesses succeed also takes them away from making sure that the wealth created is optimised.Let’s examine Tommy’s assets and see how it measures up (see chart).

The RM6mil in fixed deposit generate approximately 2% interest income. However, notice that the 2% of interest is not sufficient to offset the 4% inflation provision. As a result, there is negative net income coming from Tommy’s fixed deposit asset.

Tommy’s properties are worth RM3mil and only generates RM50,000 in rental income per annum. Nevertheless, this can be considered a net income because inflation will be hedged by capital appreciation (at least 4% per annum) of the properties.

The RM1mil in shares gives a total return of 5%. Factoring 4% inflation, the actual income received from share investment is RM10,000.

Unfortunately, the RM2mil unit trust investments didn’t offer any returns. After inflation provision, his unit trust investment has a net income of RM80,000.

The reality is if nothing is done now, Tommy’s wealth will continue to shrink by RM140,000 a year once inflation is factored to the equation. How does this play out for Tommy? The fact that he needs RM360,000 a year to maintain his current lifestyle will not augur well for him.

So, how can you prevent from ending up in Tommy’s situation?

The optimisation measures

> Remember to review the performance of each of your investment asset classes. In order to generate more income and gains, be proactive in getting rid of poor quality and poor performing investments. Look at each investment and ask yourself, should you keep it or should you sell?

> Consider moving fixed deposit into higher return investment.

Any gains from your fixed deposit would probably be eroded by inflation, especially given the current low interest, which will probably persist for quite some time. After calculating and providing for your emergency fund cash reserves, the balance of your fixed deposit should be invested into other investments that can generate higher return and income to hedge against inflation.

> Diversify the source of retirement income

Even if one investment asset can give you a good income and hedge against inflation, it does not mean that you must bet all or the majority of your wealth in it. For example, property investing. Some investors have found success in it. They were able to generate good capital appreciation and rental income.

As a result, they put a majority, if not all, of their wealth into properties. It may sound logical at first but rental income is not sustainable in the long run. It is subjected to changes, some of which cannot be controlled. Therefore, the best practice is still to diversify your retirement income across different asset classes, like share dividends and capital gains, unit trust gains, bond investment gains, retirement income products and others, so that it is not badly affected by any one impact.

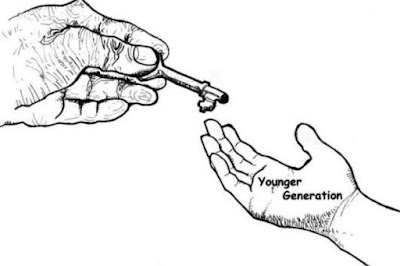

The ability to grow your wealth during retirement years is important. Just because you have stopped working, it does not mean your money should stop working too. The idea behind wealth optimisation is to ensure that you can upkeep your retirement lifestyle and protect your wealth from inflation.

Ideally, one should get a plan done a few years prior to retirement to see how your retirement income would play out. After all, you wouldn’t want to have any unpleasant surprise, like in Tommy’s case. When you have time on your side, you can improve your investing skills and adjust your retirement plan accordingly while still in your active income earning years.

Yap Ming Hui is a licensed financial planner. The views expressed here are the author’s. Any reliance you place on the information https://www.thestar.com.my/business/business-news/2021/01/09/generating-sustainable-retirement-incomeshared is therefore strictly at your own risk.