Learn new ways to budget, save and invest

“Avoid free/paid courses given by ‘investment guru’ who are not professionally qualified. The public must be aware and know how to differentiate them.’’- Kimberly Law

LOSING money is the hardest misfortune if you have just enough income for survival.

Many people have fallen victims to scams and have lost money in a bad investment.

Some have lent money to others but the loan was not repaid.

There are many reasons why people lose money and in the current times, every ringgit counts.

The costs of buying groceries, clothes, medical supplies and even essential body care items have risen so much that at the end of the month your salary may not be enough.

It is no surprise that a survey by Capital Market Research Malaysia (ICMR) showed that 64% of Malaysians respondents, feel that they are either financially unstable or are living from salary to salary.

Even Deloitte’s recent survey has indicated that 65% and 70% of the local Gen Z and millennials are living from hand to mouth. The global numbers are 51% and 52 respectively.

The majority of those within these categories report suffering from mental stress with regard to their finances.

It said there are still gaps between awareness and application when it comes to good savings behaviour.

There are gaps in financial literacy in the country and the rising rate of people falling to scams is also a concern.

Financial literacy is about how you budget, save, build credit, borrow, repay debt and invest to grow money.

If you want shortcuts by hoping your money will double or triple in the shortest amount of time then you ought to ask yourself if that is really possible or if it is part of a scam.

Everyone knows how to manage money, but the question is how effectively is it managed and whether you are making your money work for you.

There are many management and personal finance courses available to improve your financial literacy skills.

Some are offered free and some charge a fee. It is not wrong to learn and improve one’s skills even though you may be an expert in money management.

Several websites offer personal finance, money management courses available. Some are free, others charge less than RM100.

Some of the sites that offer courses include Udemy, Coursera, LinkedIn.

Often in a few hours of online learning, you will be able to create a format and update your budget or even create a plan using the tools they provide to help you reach your financial goals, according to a report.

However, Uno Advisers Sdn Bhd licensed financial planner Kimberly Law said she would avoid the free courses offered by people who are not from the industry.

“Avoid free/paid courses given by ‘investment guru’ who are not professionally qualified. The public must be aware and know how to differentiate them.’’ she said.

She recommends those interested to attend reliable courses from institutions such as the Financial Planning Association of Malaysia (FPAM) and the Malaysian Financial Planning Council (MFPC)

She says they offer some paid programmes while others are offered free to the public for financial literacy enhancement.

For her, the best way to get free financial education is to attend/listen to events/programmes organised by FPAM/MFPC and that are offered together or with the blessings of the industry regulators such as the Securities Commission and Bank Negara.

These organisations will get professionals to volunteer to offer/teach the programmes.

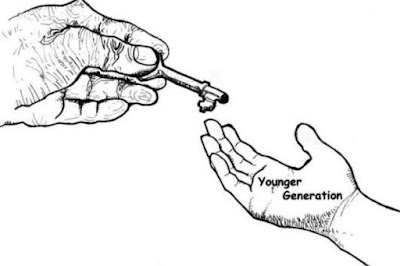

Some people felt that basic money management courses should be offered in schools to help children prepare for their future. This will surely benefit the larger school going population.

Even if it is not part of the syllabus, it can be a supplementary programme offered for a limited period of time every year at schools.

Law believes the syllabus for the young should include basic money management skills such as basic training or exercise on budgeting, managing expenses and planning that will be useful in their management of money and investments.

This will certainly raise the financial literacy rates over time in the country.

Even if you are doing well in your money management skills, it doesn’t hurt to enhance and learn new ways to budget, save and invest.

But don’t fall for courses that will make you invest even before you can learn something from it.

Related posts:

Financial literacy and bankruptcy