Group alleges corrupt practices by top Securities Commission (SC) officials

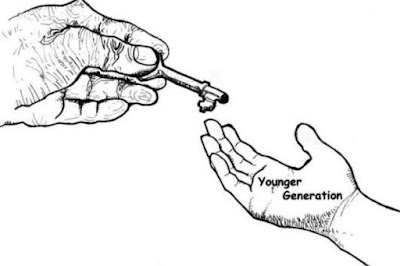

Potential probe ahead: A view of the SC building in Kuala Lumpur. Rakyat Malaysia Prihatin has cited three cases of alleged wrongdoing by high-ranking SC officials.PETALING JAYA: A group has come forward to lodge a report with the Malaysian Anti-Corruption Commission (MACC) alleging corrupt practices by high-ranking Securities Commission (SC) officials.

`

The non-governmental organisation calling itself Rakyat Malaysia Prihatin claimed to have evidence of alleged wrongdoings that also involved politicians holding top government posts.

`

“I want the MACC to investigate this matter immediately. We do not want the integrity and image of the SC to be tarnished due to such cases,” an unnamed representative of the group told Utusan Malaysia after lodging the report with MACC in Putrajaya at about 4.30pm on Sunday (Jan 9).

`

The representative cited three cases, the first involving a relative of a senior SC management official who was allegedly given a top post in a company.

`

The company in question was being investigated by the SC with the appointment being an alleged inducement to cover up the company’s wrongdoings.

`

“There is also a case involving conflict of interest, where a SC board member is alleged to be holding shares worth RM28.2mil in a company which has a working relationship with the commission.

`

“The third case involves high-ranking SC officials taking bribes to close cases involving insider trading by public-listed companies,” the representative claimed.

`

The group said it was acting as "concerned rakyat" who wanted to ensure that government agencies are clean and not corruptly used for personal gain.

`

It then added that it would provide the MACC with proof of the wrongdoings once investigations begin.

MACC studying NGO report

`

PUTRAJAYA: The Malaysian Anti-Corruption Commission (MACC) is going through a report lodged by a non-governmental organisation against the Securities Commission (SC).A senior official confirmed that the report was lodged on Sunday by a group calling itself Rakyat Malaysia Prihatin.

`

The NGO has alleged that there are corrupt practices by high-ranking SC officials.

`

It also claimed to have evidence of alleged wrongdoings that involved politicians holding top government posts.

`

“Yes, we have received the report. MACC officers are going through it before we decide to open investigation papers or not,” said the official when contacted.

`

This, the official added, was the procedure each time a report was lodged.

`

To a question, the official said it was not unusual to have people wanting to lodge reports to MACC on weekends or public holidays.

`

“It has been done before. We have officers on standby 24 hours a day, seven days a week,” said the official.Several attempts were made to contact the NGO members for comment yesterday.The Star managed to get hold of the contact number of its representative, but the phone was answered by a person who claimed that he was not the person this reporter was looking for.

`

On Sunday night, Utusan Malaysia reported about the NGO going to the MACC.“I want the MACC to investigate this matter immediately. We do not want the integrity and image of the SC to be tarnished due to such cases,” an unnamed representative of the group was quoted as saying after lodging the report with MACC in Putrajaya at about 4.30pm on Sunday.

`

He cited three cases, the first involving a relative of a senior SC management official who was allegedly given a top post in a company.

`

The company in question was being investigated by the SC with the appointment being an alleged inducement to cover up the company’s wrongdoings.

`

“There is also a case involving conflict of interest, where a SC board member is alleged to be holding shares worth RM28.2mil in a company which has a working relationship with the commission.

`

“The third case involves high- ranking SC

`officials taking bribes to close cases involving insider trading by public-listed companies,” the representative claimed.

The group said it was acting as “concerned rakyat” who wanted to ensure that government agencies were clean and not used for personal gain.It also said it would provide the MACC with proof of the wrongdoings once investigations began.

` Source link