IN recent weeks, global markets were roiled by the mere mention of a four-letter word, debt. From China’s Evergrande Group’s near collapse, as it sat on a mountain of liabilities, to the United States government’s need to raise its debt ceiling.

In Malaysia’s case, we too have not much choice either but to raise our debt ceiling as we look at ways to re-generate the economy with a higher debt room of 65% of gross domestic product (GDP) from 60% currently.

It seems like debt has become one dirty word for investors for the time being, as we all know there is a price to pay when it comes to debt as there is no such thing as a free lunch.

For the US, there is no doubt that they have constantly raised their debt ceiling over the years to ensure they do not default on their obligations.

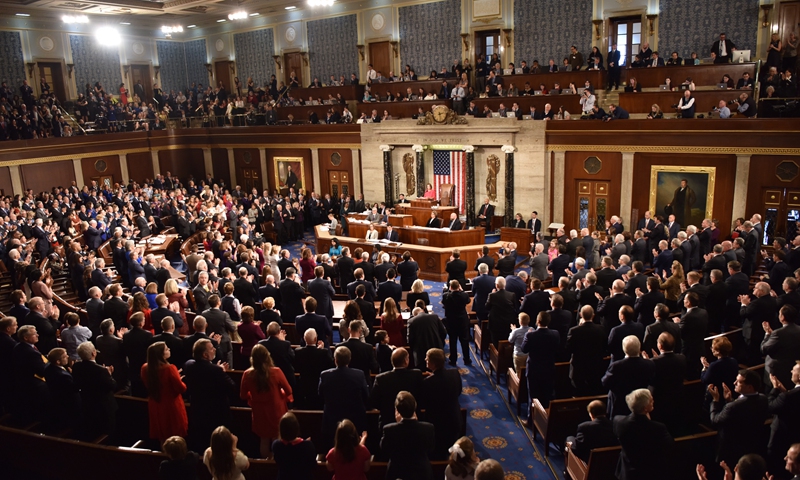

According to the US Treasury website, since 1960, Congress has acted 78 separate times to permanently raise, temporarily extend, or revise the definition of the nation’s debt limit.

Currently suspended, the US debt ceiling was reset on Aug 1, 2021, to US$28.4 trillion (RM118.9 trillion). For the US, failure is not an option as it will lead to a catastrophic chain reaction to not only the financial market but to the economy as a whole.

According

to Treasury Secretary and the former Federal Reserve (Fed) chairperson,

Janet Yellen, (pic) the US has never defaulted on its debt before and

she was “confident” that the issue would be addressed, despite warning

the Congress that the deadline for the debt ceiling is “around Oct 18”.

According

to Treasury Secretary and the former Federal Reserve (Fed) chairperson,

Janet Yellen, (pic) the US has never defaulted on its debt before and

she was “confident” that the issue would be addressed, despite warning

the Congress that the deadline for the debt ceiling is “around Oct 18”.

According to Treasury Secretary and the former Federal Reserve (Fed) chairperson, Janet Yellen, the US has never defaulted on its debt before and she was “confident” that the issue would be addressed, despite warning the Congress that the deadline for the debt ceiling is “around Oct 18”.

For now, while a nine-week stopgap funding bill has been endorsed by the President on Thursday, which in all likelihood will avoid a government shutdown at least up to Dec 3, 2021, the threat of a US defaulting on its debts remains.

While the US is able to continue to print money by simply passing the law to keep borrowing, the US, just like any other country, cannot go on borrowing forever. With a greater supply of money, sooner or later, interest rates will have to rise as the increase in money supply will likely fuel inflation.

After all, the Fed too expects rates to start rising in 2022 and much more in 2023 onwards.

In the last Federal Open Market Committee just over a week ago, the 10-year and 30-year US benchmark rates have already moved 17 basis points (bps) and 21 bps to 1.50% and 2.06% respectively – as the market begins to price in expectations of the Fed’s tapering move as well as worries if there is going to be lengthy impasse between the Democrats and the Republican or grand old party (GOP) to raise the debt ceiling.

Having said that, as the US has been running budget deficits for the longest time, it would not be too far-fetched to assume that given time, the US will need to raise the debt ceiling yet again in the future.

Hence it was also of no surprise when Yellen commented on Thursday that the debt ceiling ought to be permanently abolished.

In any government’s financial management, it’s either shortfall or revenue, mainly due to inadequate tax collections or excessive spending, which are also a function of debt service charges, and to a certain extent, over-priced development spending or operating expenditures.

With a current debt-to-gdp of about 125%, the US is not the only country with a huge mountain of debts.

So is the rest of the world. In fact, according to the Institute of International Finance (IIF) in its Global Debt Monitor report published on Sept 14, 2021, global debt, which includes government, household and corporate, and bank debt increased by US$4.8 trillion (RM20 trillion) to reach a new alltime high of US$296 trillion (RM1.24 quadrillion).

In essence, over the past six quarters, as the pandemic has caused significant damage to the global economy and unprecedented response from governments, total global debt has expanded by US$36 trillion (RM150.7 trillion) or 13.6% from just about US$260 trillion (RM1.09 quadrillion) as at end of 2019.

Money has to go somewhere

When a debt is raised, be it by the government, a company, or a household, it has to go somewhere. For most governments, debts are mainly raised for development expenditure, and if it is allowed by the constitution, on operating expenditure too.

Debts raised due to the pandemic perhaps has become the norm globally as well, as the government has no choice but to raise the required funding to support the economy.

In the US, the Fed also buys US treasuries and agency mortgage-backed securities and this effectively makes its way into the financial markets.

So while the Fed has expanded its balance sheet by more than 100% since the pandemic, the liquidity it has provided has caused significant gain not only in traditional asset classes but into everything else. Home prices are rising, commodities have boomed and markets are buoyant and cryptos have soared.

In the case of Evergrande Group, many are left wondering if it was a case of a “too-big-to-fail” company. Evergrande became a property developer largely by borrowing.

As a group, they also ventured into other businesses, which among others include electric vehicles, Internet and media production, theme park, football club, and even into mineral water and food production.

Evergrande’s massive business empire, grown out of debt means, while it has substantial assets, it also had huge liabilities. As Beijing has been strong in putting its house in order in the form of new regulations and guidelines for many industries, Evergrande too was not spared.

As early as August last year, the Chinese government had introduced a “three red lines” test for developers to meet if they wanted to borrow more.

This was firstly, liability to asset ratio of not more than 70%; secondly, net debt to equity ratio of not more than 100%; and thirdly cash to short-term debt ratio of more than 1.0.

Hence, the writings were already on the wall on Chinese developers more than a year ago that the regulators were serious in addressing debt-driven growth pursued by these companies. In Evergrande’s case, the debt hit the ceiling.

Why do we go into debt?

Debts taken by individuals are rather straightforward. Of course, there are good debts and bad debts. For most of us, it is for the purchase of big-ticket items like a roof over the head, and for mobility purposes, where most of us own a car.

Of course, we also indulge ourselves with material stuff, either from our savings or credit cards that we will pay off when the time comes. Some of us, due to lack of income or due to financial mismanagement, take on bad debts and that’s where the trouble starts as we are unaware of the consequences of rising personal debts and high-interest cost.

Stories of debts owed to money lenders are common within our society while Bank Negara statistics also show that one of the fastest-growing debt profiles among individuals is personal loans.

This has remained relatively high and has increased by 87.4% over the last five years alone to about Rm73.7bil as at end of August 2021, while its share of the banking system loans outstanding has increased from 2.7% to as much as 4.0% now.

According to Bank Negara’s Financial Stability Review report for the first half of 2021, Malaysia’s household debt to GDP has declined to 89.6% from 93.2% as at end of last year. Although a small achievement, the household debt level remains elevated.

For a company, debts should be part of capital management as companies need to not only sustain their business operations but look at opportunities to grow and expand their market share, either via acquisition or via borrowings. However, similar to what we have seen in Evergrande’s case, companies too must observe their own “three-red-lines” to ensure they have the right mix and remain vigilant of its exposure.

Does Malaysia have the room to borrow more?

For Malaysia, with a higher debt ceiling of 65%, the government is effectively allowing itself to have some headway to borrow an additional Rm75bil to support the recovery momentum that most economists now expect will be much stronger in this fourth quarter period and 2022 and as we prepare ourselves for the post-pandemic period.

While we have created this room to enable us to borrow more, we must be mindful to borrow responsibly as debts that are taken today will be borne by future generations.

We also need to chart our way out of this debt-dependency black hole that we have been in since the Asian Financial Crisis of 1998 and get out of this conundrum.

While debt-to-gdp is just a denominator that is divided by a numerator that is steadily growing, we must find ways to manage our overall federal government debt and plan to reduce them post-pandemic.

That is a whole new topic altogether, and next week, this column will explore strategies that Malaysia can deploy to reduce its debt dependency.

PANKAJ C. KUMAR Pankaj C Kumar is a long-time investment analyst. The views expressed here are his own.

Source link

US federal debt crisis uglier than Evergrande trouble

There is much buzz amongst global investors recently about two possible debt defaults, though they are of different proportions in their would-be impact on global equity markets. One is the US federal government's rivers of borrowed money running dry and in urgent need of replenishing. The other is a major Chinese property developer which has run into financial trouble, because the company veered off the road by squandering too much on making electric cars and sponsoring a football club.

As US federal debt default looms, US Treasury Secretary Janet Yellen is facing her biggest test in her eight-month tenure to convince reluctant Republican lawmakers to agree to raise the US' national debt limit, which is currently set at $28.5 trillion. The stakes are high, because if Yellen's effort fails, the US financial system will collapse.

Yellen has called Republican leaders to convey the economic danger which lays ahead, bluntly warning that the Treasury Department's ability to stave off default is limited, and the failure to lift the debt cap by late October would be "catastrophic" for the country and the world.

Six former US treasury secretaries last week sent a letter to top US lawmakers, warning them a default would roil financial markets and blunt economic growth. According to US media reports, Yellen last week also warned the nation's largest banks and financial institutions about the very real risk of a default. She has spoken to chief executives of JPMorgan Chase, Bank of America, BlackRock and Goldman Sachs, briefing them the likely disastrous impact a federal default will produce.

To make things worse, both Democrats and Republicans in the US are at each other's throats now over US President Joe Biden's new $3.5 trillion spending bill, which proposes heavy tax raises on rich families and corporations, and has met fierce opposition from Republican lawmakers. Whether they will compromise on the debt limit, by making a last-minute deal with the White House to reduce Biden's giant spending plan remains to be seen.

Market analysts say if the US government defaults on its colossal debt, a financial system crisis of a magnitude larger than the 2008-09 debacle could occur, which is estimated to lead to an evaporation of $15 trillion in wealth and loss of 6 million jobs in the US. The capital market is now on tenterhooks facing a potential financial time bomb.

Last week, the US' major media outlets also focused their reportage on a possible default of a leading real estate developer in South China, but by all metrics, it is a risk of much smaller scale. The case is being closely watched by China's financial authorities and will never be allowed to develop into a systemic risk.

With regard to the privately-run property developer Evergrande, many fear the knock-on effects of the company's imminent difficulty to pay back principals and interests of borrowed money, including corporate bonds and bank loans. But, even if the city of Shenzhen with its deep pockets, where the company is headquartered, refuses to bail out Evergrande, one bankrupt company can hardly impact the stability of China's financial system, and the risks linked to this possibility have been widely overblown by a hyperventilating media.

Executives at Evergrande are launching a last-ditch rescue effort, trying to sell the company's electric car subsidiary and other assets in China and abroad, including the Guangzhou Evergrande Football Club. It is also selling its housing projects scattered in dozens of Chinese cities at a discount to speed up its cash flow. Whether the company is able to stave off a debt default remains unknown.

Evergrande said on Wednesday that it would make an interest payment on an onshore bonds due Thursday, but the company didn't say whether it had plans to make a $83 million coupon payment due on its US dollar bonds within a month.

The city government of Shenzhen, or the central government in Beijing, has not rushed to bail out Evergande most likely in the belief that the company itself is to blame for the predicament - too much leverage and squandering of borrowed funds ploughed into auto making and other fringe businesses and budgeting largesse. Authorities probably want the case to serve notice to investors at home and abroad, that they need to do their due diligence and enforce accountability on debtors.

However, the central government is almost certain not to tolerate a possible bankruptcy of Evergrande to spill over to draw down the broader Chinese economy, as the central bank has done numerous pressure tests since the 2008 global financial crisis, which was caused by the sub-prime housing debts in the US. Last year, the central bank required property developers to bring down their debt levels below certain thresholds before they are able to borrow more money from financial institutions. And, many Chinese commercial banks have ascertained their exposure to Evergrande is restricted.

So, debt-beleaguered Evergrande is unlikely to produce a firestorm and disrupt China's financial system. In addition, both the government and the central bank have plenty of policy tools, including easing overall monetary policy, to tide over Evergande if it goes under. But of course, the last resort is to bail it out and restructure the company, as China has done with other troubled corporations like HNA, Huarong and Baoshang Bank.

The author By Wen Sheng is an editor with the Global Times.

Related:

Government to table motion on raising statutory debt limit to 65% of GDP

https://www.thestar.com.my/business/business-news/2021/09/30/government-to-table-motion-on-raising-statutory-debt-limit-to-65-of-gdp

As discussion about Evergrande Group has continued to ferment, the Chinese real estate giant said it will pay ...

Business

Roundtable, an association of over 200 chief executive officers (CEOs)

of America's leading companies, on Wednesday warned ...

While the withdrawal from Afghanistan war has triggered reflection on US military interventions across the world over the ...

Related posts:

The policy options open to major economies, including China, to reduce debt, before another global crisis hits

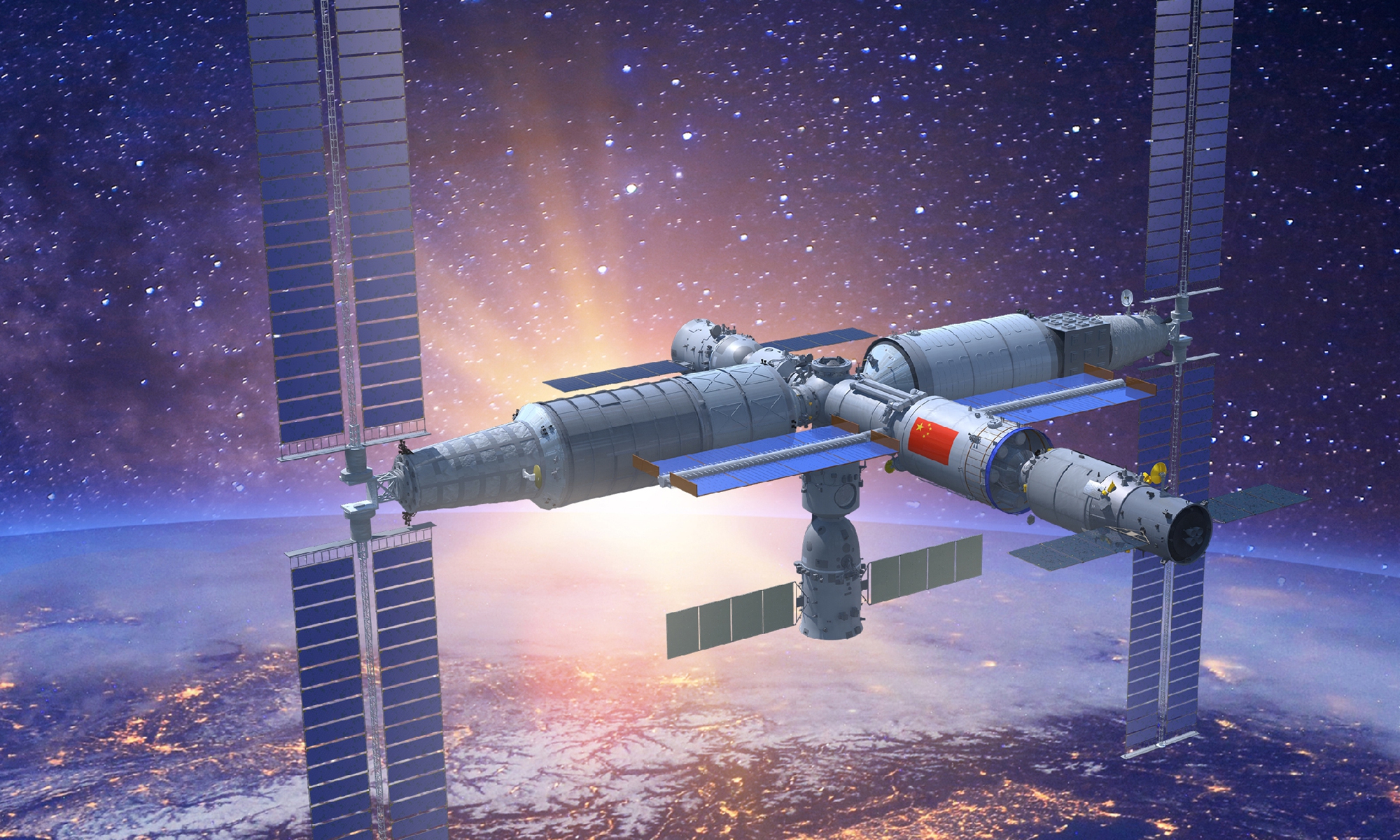

Shenzhou-13 crew

Shenzhou-13 crew

According to Bank Negara’s Financial Stability Review report for the first half of 2021, Malaysia’s household debt to GDP has declined to 89.6% from 93.2% as at end of last year. Although a small achievement,the household debt level remains elevated.

According to Bank Negara’s Financial Stability Review report for the first half of 2021, Malaysia’s household debt to GDP has declined to 89.6% from 93.2% as at end of last year. Although a small achievement,the household debt level remains elevated.