Bank Negara’s plan to issue up to three virtual banking licences has excited the local financial sector which otherwise has begun to look a little lethargic.

BANK Negara’s announcement this week which

stated that it is looking to issue up to three virtual banking licences

has excited the local financial sector which otherwise has begun to look

a little lethargic.

The announcement comes at the same time as Hong Kong’s move to issue three licences of this type to a combination of companies partnering finance firms, namely Standard Chartered, BOC Hong Kong Holdings Ltd and online insurance company ZhongAn Online P&C Insurance Co.

Five more of such licences in the city are being processed.

In Malaysia, the announcement by Bank Negara is significant also because the central bank has not issued any new banking licences for many years now.

That said, both Hong Kong and Malaysia’s move to encourage pure online banking ventures is very much in line with the fact that fintech innovations are slowly but surely seeping into the daily lives of people globally, providing cheaper and more easily accessible financial services.

The idea of virtual banks – which theoretically means a bank without any physical branches whatsoever – however, is not entirely new.

In fact, many countries such as the United States and the United Kingdom have attempted it.

Some have failed, others continue to operate, taking deposits and giving out loans much like traditional banking outfits.

Closer to home, India, China, South Korea and Japan have ventured into this model.

Japan, for instance, went for the zero branch strategy as far back as the 1990s with the setting up of Japan Net Bank.

There have been other Internet banks there since then such as Seven Bank which has been providing financial services via ATMs across 7-Eleven convenience shops in Japan since the early 2000s.

In South Korea, the then-chair of the Financial Services Commission, Yim Jong-yong gave initial approval for the setting up of the country’s first two virtual banks back in 2015.

K Bank was its first, starting operations in April 2017 followed a few months later by kakaobank, which started with some W300 billion (about RM1.077bil) in start-up capital.

To be sure, virtual banks, which primarily target the retail segment including the small and medium-sized enterprises (SMEs), have existed even before the concept of fintech – which is basically using technology to provide improved financial services – gained prominence over the last few years.

The rise of fintech in recent times can be attributed to consumers becoming increasingly tech-savvy and more demanding when it comes to convenience on-the-go.

It also stems from the fact that there are millions of individuals who are unbanked or underbanked but who now have access to the Internet.

In China alone, mobile payments run in trillions of yuan.

It is perhaps this increasing savviness that is contributing to regulators the world over wanting to push for more virtual banks and easing guidelines to fit the concept in.

It is noteworthy that within the Asean region, Malaysia is among the first to attempt this virtual bank model.

Timo, Vietnam’s first bank sans any traditional branch, was officially launched in 2016 while nearest neighbour Singapore currently does not have any banks purely of this nature.Even so, Bank Negara governor Datuk Nor Shamsiah Mohd Yunus has said that the central bank is currently working towards releasing licensing guidelines for such operations only by the end of this year.

She has stressed that discussions with the few parties interested in setting up virtual banks in Malaysia are still at the preliminary stage.

Still, that’s not stopped industry people from raising questions, many of which are valid.

For starters, notwithstanding theoretical definitions, what will be the exact definition of a local virtual bank ?

What are the rules?

“Who can apply to operate such banks and will these guys be subject to the same rules that apply to traditional banks such as those involving capital requirements and such?” asks one senior banker attached to a regional bank.

While the jury is still out on rules that will apply in Malaysia should the idea materialise, a broad idea on this can be gleaned from the guidelines that have been set out by the Hong Kong Monetary Authority (HKMA).

According to the HKMA, firstly, a “virtual bank is defined as a bank which primarily delivers retail banking services through the Internet or other forms of electronic channels instead of physical branches”.

HKMA’s guidelines include rules such as virtual banks having to play an active role in promoting financial inclusion when offering their banking services.

“While virtual banks are not expected to maintain physical branches, they should endeavour to take care of the needs of their target customers, be they individuals or SMEs,” it says, adding that virtual banks should not impose any minimum account balance requirement or low-balance fees on their customers.

In terms of ownership, the HKMA says that because virtual banks will mostly be focused on retail businesses covering a large pool of such clients, “they are expected to operate in the form of a locally-incorporated bank, in line with the established policy of requiring banks that operate significant retail businesses to be locally-incorporated entities”.

It also says that it is generally its policy “that a party which has more than 50% of the share capital of a bank incorporated in Hong Kong should be a bank or a financial institution in good standing and supervised by a recognised authority in Hong Kong or elsewhere”.

While the guidelines cover a lot more, it is worthwhile pointing out that the HKMA is of the view that “virtual banks will be subject to the same set of supervisory requirements applicable to conventional banks”, with some of the rules being changed in line with technological requirements.

It adds that in terms of capital requirement, “virtual banks must maintain adequate capital commensurating with the nature of their operations and the banking risks they are undertaking”.

Noticeable absence of tech players

Interestingly, in the first round of licences given out by the HKMA, there was a noticeable absence of major Chinese tech companies like Tencent Holdings Ltd and Alibaba Group Holding Ltd’s Ant Financial, which many would have thought make obvious choices given their experience in carving out game-changing fintech-centric services especially in their home country of China.

“Mobile payment services offered by the likes of WeChat and Alipay are possible with Internet giants like Alibaba and Tencent behind the entire ecosystem, the fact that they were not included raised some eyebrows,” says one Hong Kong-based banking analyst.

In the same vein, Hong Kong has been criticised for not being proactive enough when it comes to encouraging financial start-ups and being overly protective of conventional banks as evident in its fintech sandbox programme of 2016, which was reportedly introduced to help traditional financial institutions try out new technology instead of supporting fresh start-ups.

“Still, a start is better than no start and we are looking forward to when these virtual banks start operating in nine months’ time,” says the analyst.

He adds that as long as security is not an issue, he hopes that virtual banks will be able to provide what traditional banks are “still not good at”, namely personalised customer service and cheaper services.

While it is early days yet in Malaysia, the general feedback is that virtual banks will be good, specifically for consumers who will have more choices.

But this will come at the expense of increased competition within the banking sector.

Analysts in Hong Kong have predicted that about 10% of revenue belonging to traditional banks there will be “at risk” over the next ten years because of the setting up of virtual banks.

Whether or not it will be the same for Malaysian banks remains to be seen.

A lot of this will depend on the guidelines that the central bank plans to set out in the months to come.

By Yvonne Tan The Star

Breaking ground with new banking concept

|

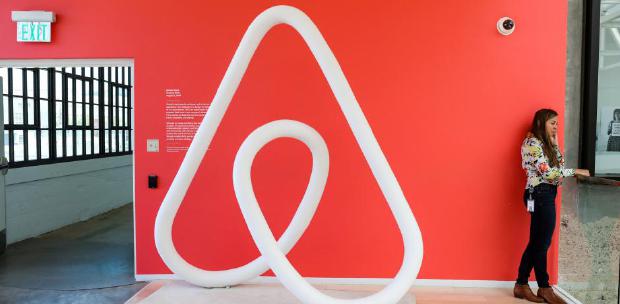

| Backed by Ma: MyBank is backed by billionaire Jack Ma’s Alibaba Group Holding Ltd. Alibaba affiliate

company Ant Financial owns 30% of the online lender. (Photo: AFP) |

(The Star Online/ANN) - DURING the height of the fintech revolution that’s been taking place over the last few years, one prominent banker in Malaysia made an interesting comment during a private dinner.

The banker said that while he welcomes fintech companies into the market, he wasn’t really afraid of losing any significant business to them. What he really feared, if anything, were the technology giants turning on a banking facility for the millions of users they have on their platforms.

“This Facebook Bank, Google Bank or Whatsapp Financial Group,” he quipped in half jest.

The logic is simple: with those platforms even then having had the myriad users globally, they are able to tap that user group to offer financial services.

But banking remains a highly regulated space. Not every technology company will be able to fulfill those criteria or even have such intentions.

Still, there are a number of virtual banks that have sprung up globally.

Here are some of the more notable ones in this part of the region.

China: WeBank

WeBank is China’s first private digital-only bank, launched in early 2015.

It is backed by tech giant Tencent Holdings – China’s biggest messaging and social networking company, which is also the operator of WeChat

Besides Tencent, its other backers include investment firms Baiyeyuan and Liye Group.

According to its website, WeBank provides consumer banking services through digital channels, as well as microcredits and other loan products.

The Internet-only lender had turned in a profit one year into operation thanks to surging demand for microloans among blue-collar workers and small entrepreneurs.

In 2017, WeBank made a net profit of 1.4 billion yuan or US$209mil, while its return on equity came in at 19.2%.

Its total lending in that year was nearly twice that of closest rival MyBank for the same period.

A recent stake sale of the bank values the company at US$21bil, making it one of the world’s largest “unicorn” companies.

Banking Tech recently reported that the lender is now eyeing an Australian expansion to compete with payments company Alipay, which is its largest rival.

MyBank

MyBank is backed by billionaire Jack Ma’s Alibaba Group Holding Ltd.

Alibaba affiliate company Ant Financial owns 30% of the online lender.

Not unlike WeBank, it has a focus on consumer and small and medium-sized enterprises, a sector underserved by traditional banks in China.

It uses credit data from the e-commerce giant’s AliPay product to conduct analysis for loans.

By circumventing human involvement, the bank said it was able to deliver loans to borrowers faster and up to 1,000 times less than it would cost brick-and-mortar banks to do so.

Like WeBank, it turned profitable one year into operations due to its less capital-intensive model.

Ant Financial is reportedly looking to go public in the near future.

India: Digibank

Singapore’s banking giant DBS Bank launched Digibank in April 2016 – a move that has enabled it to penetrate the Indian retail banking market.

Breaking away from conventional banking norms with their onerous form-filling and cumbersome processes, Digibank incorporates a host of ground-breaking technology, from artificial intelligence to biometrics.

DBS CEO Piyush Gupta expects the mobile-only bank to break even in three to four years, which according to him is not such a bad deal as compared to the traditional branch model, which needs 15 to 20 years to break even.

Digibank has over 1.5 million customers and it is handling them with 60 people rather than the 400-500 staff members it would normally need under the traditional model. Its cost-to-income ratio is in the low 30s.

Following its Indian venture, DBS went on to launch a similar mobile-led bank in Indonesia where the government expects the country’s digital economy to reach US$130bil or about 12% of its gross domestic product in 2020.

Other Singaporean lenders have also jumped on the bandwagon. United Overseas Bank (UOB) said it would launch “digital banks” for its five key markets in Asean, starting in Thailand. It aims to have three to five million customers in the next five years

Elsewhere, OCBC is also reportedly pursuing a similar idea in Indonesia.

Japan

Established in 2008, Jibun Bank reached profitability in less than five years. The outfit is a joint venture between Bank of Tokyo-Mitsubishi UFJ and local mobile network operator, KDDI.

The story goes that instead of competing with each other, the two organisations decided it would make more sense creating a “separate bank” that complement their goals.

The Asian Banker in a case study on Jibun Bank noted that in its first year, the lender had accumulated over 500,000 new customers. By 2015, Jibun Bank’s asset volume surpassed that of Japan’s oldest Internet bank, Japan Net Bank. Asian Banker also noted that the lender’s deposit volume has grown to a size that is comparable to that of a mid-tier regional bank – all of this without the help of a branch footprint.

South Korea: K-bank and Kakao Bank

The two South Korea’s online-only banks have signed up new customers by the millions since beginning operations in 2017.

Kakao Bank is run by mobile messaging Kakao and Korea Investment Holdings, while K-bank is operated by telco KT.

The authorities there are hoping that K-bank and Kakao Bank would spur growth in a banking industry that has stagnated amid rising credit costs, narrowing interest margins and heavy regulation.

The Financial Times in an October 2017 report wrote that about 300,000 new accounts were opened with Kakao Bank in the 24 hours following its launch in late July. This figure was more than what traditional banks in South Korea got in a year through online channels. And as at end-September that year, it had already garnered 3.9 million users.

The news agency said that Kako Bank users can wire money abroad for just a tenth of typical commission fees.

Its peer K-bank, meanwhile, attracted over half a million users in the few months following its April 2017 launch.

In contrast, international banks operating traditional branch networks in the country were looking at downsizing their branches.

Early this year, Shinhan Financial Group inked a deal with mobile app maker Viva Republica to set up an Internet-only bank, making it the third player in the game.

by

gurmeet kaur The Star

Related:

https://youtu.be/OCk4VkAKKFc

https://youtu.be/OCk4VkAKKFc