WITH the World Health Organisation declaring Covid-19 no longer a global health emergency and countries opening their borders, we have seen a resurgence in the tourism industry.

Airlines such as Singapore Airlines have declared a record high quarterly profit of S$2.16bil (Rm7.37bil) in its 76-year history.

People are finally travelling again, be it for work or leisure. Yet, the irony of it is the weakness of our local currency.

This has led to many lamenting across social media about our foreign-exchange weakness and the voice of discontent has been growing by the day.

People are bewildered because our underlying economy remains resilient and there are no signs that we are heading anywhere close to a recession.

Even after Bank Negara embarked on a pre-emptive rate hike of the overnight policy rate (OPR) surprising the market, it couldn’t stymie the continued weakness of the ringgit.

So, what is happening?

Factors affecting a currency

In the study of Economics 101, foreign currency is parked under the chapter of macroeconomics.

This means that a currency’s movement is determined pretty much by macroeconomic factors such as inflation, fiscal policy, employment levels, national income and international trade.

Hence, it is impossible to pinpoint our currency’s prolonged weakness on a single reason.

I have heard all sorts of talk in the coffeeshop, including political instability, increasing fiscal deficit, shrinking current account surplus, the US debt ceiling crisis, the weakening oil price and looming recession, among others.

The above-mentioned factors all play a part in contributing to the weakness and none can stand alone to be deemed as the root cause of the issue.

Otherwise, it would be a rather easy fix.

As everything is intertwined and linked, it is important to look at our ringgit weakness from a more holistic perspective.

Exactly 10 years ago, the ringgit’s strength peaked in January 2013 at RM2.96 against one US dollar as the United States was undergoing large-scale quantitative easing to dig itself out of the 2008 Global Financial Crisis.

Another reason was because the Brent oil price hit a high of US$125 per barrel, record levels at the same period.

There were many reasons that gave confidence to boost the ringgit’s performance as Malaysia was an oil exporter with large infrastructure projects being rolled out by the government of the day.

Even the property market was booming with many foreign buyers and real estate developers venturing into our local markets.

It all went downhill after the 1Malaysia Development Bhd scandal surfaced and the national debt ballooned to astronomical levels with little to show for.

With the oil price correcting to record low levels and large amounts of government allocations being used to defray interest expenses on the debts, this expanded our fiscal deficit.

It all comes down to demand

We often hear about the emphasis on foreign direct investment (FDI).

This is because with FDI, it will promote employment, transfer of skills and business opportunity, among others.

Additionally, from an economic standpoint, FDI increases the money supply and inadvertently the demand for the ringgit.

When FDI falls, demand falls. From the data gathered by the Investment, Trade and Industry Industry, the problem is with domestic direct investment (DDI) rather than FDI.

For the past decade, DDI has been a straight line downward trend.

This effectively means local businesses are not reinvesting their profits or expanding locally as much.

To me, it is a bigger indicator that whatever funds or profits from local businesses are being moved towards the current account, savings account or worst, foreign outflow.

There is little to no multiplier effect and if it is an outflow, it will further reduce the demand for the ringgit and in turn weaken the currency.

Tourism is another aspect that is important to an economy.

Apart from the spillover effect of tourism spending, it is the positive carry that helps with the currency’s strength.

If tourism activity in our country picks up, naturally, there will be more need for the ringgit and in turn leading to its strengthening.

Thailand is good example of a successful tourism nation where tourism is the third-largest economic activity contributing to 20% of the gross domestic product for the country and it is only behind the two key sectors, namely, agriculture and industry.

If we look at the Thai baht performance against the ringgit, we

can see its continued strength from RM1 to 9.61 baht to RM1 to 7.52 baht.

Essentially, all three sectors of Thailand – agriculture, industry and tourism – have been growing in the past decade, which, in turn, increased the demand for their currency.

Continued downtrend

Many are very worried that this downtrend of the ringgit will continue to persist in the years to come.

If we look at what has happened historically, there are of course reasons to be worried.

In my conversation with high-networth clients, their number one concern is always inflation eroding the value of their money.

The second worry is the weakness in the foreign exchange (forex) that erodes the global monetary value of their savings.

Due to this fear, it is easy for private bankers to market foreign products or funds to these clients regardless of the returns.

A client once told me, “Even if I move my savings to Singapore and the stock market or investments do not perform, at the very least the forex carry alone would deliver 40% return in the span of 10 years.”

An indirect measure of the economy is the strength of its currency.

If everyone wants your currency to be their reserve currency, it is likely that your country’s economy is strong and healthy and vice versa.

No matter how we improve the fundamentals of our economy, there will always be a difference between a developed economy and of those developing economies.

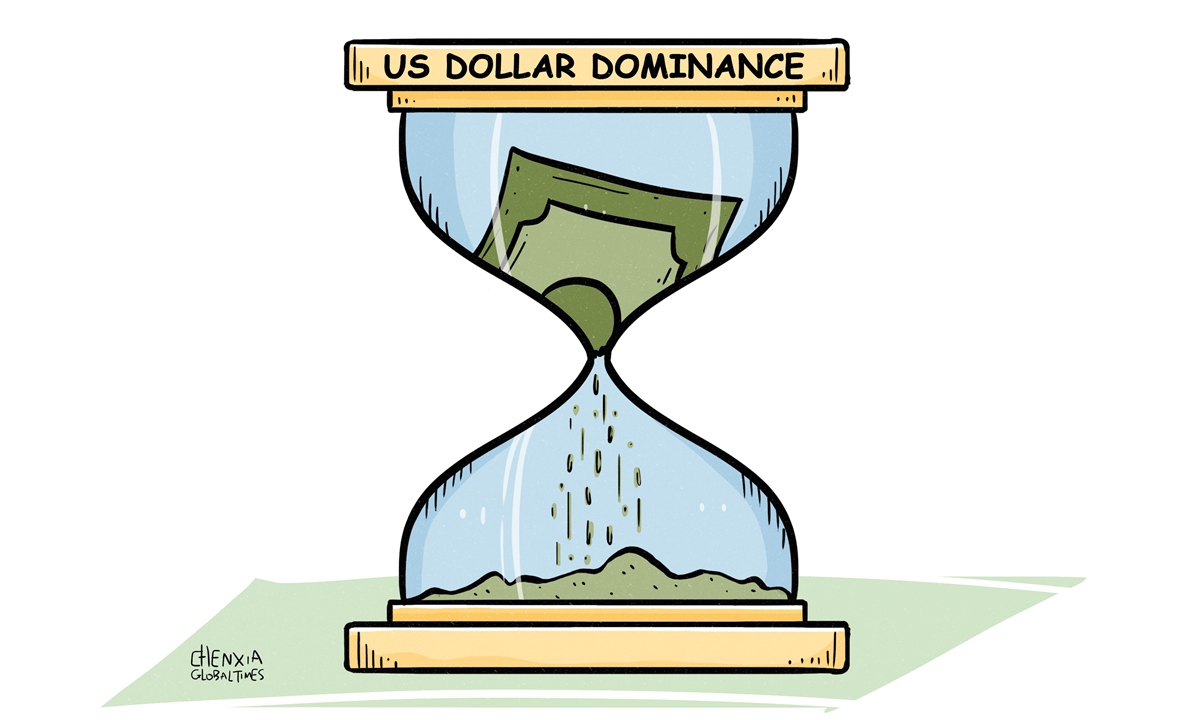

The reason the US dollar remains in demand in spite of its national debt and endless printing of money is because the value of the dollar is backed by the US government, its military strength and technological advancement.

China is also pushing for the internationalisation of the yuan and as the second largest economic powerhouse in the world, there are merits to be a highly sought-after currency.

The Singapore dollar’s value manifests in it being an anchor on stability, a haven and its function as an international entrepot.

For the ringgit, its value is probably largely still associated with commodities exporting nation.

While our exports and trade have always been a fixture, more must be done to reflect this value to the world.

Having a strong currency which is in demand is a powerful tool that can be used to a country’s advantage, especially when it comes to business and geopolitical negotiations.

There are many challenges that the government must overcome before we can turn the old economy around and upgrade it to a new model forward.

I remain optimistic about the potential of the country and the talent of this young nation to turn things around.

If we look at how blessed our country is, rich with natural resources, low population density per habitable land area, free from natural disaster, etc, the only thing impeding the progress is good governance and professional management.

To believe a new government can change this overnight (seven months to be precise) is being a tad too optimistic.

More time is needed to restructure the troubles of the past.

If we foster a healthy environment for the SMES to grow, promote food security and self-sufficiency and manage our natural resources prudently, we can become a strong economy in Asean.

A stable currency is paramount for an economy and if we improve investments and reinvestments in the country, the ringgit’s weakness is not permanent.

By Ng zhu hann