“In general, the PERMAI assistance package improves on the existing ongoing initiatives and also accelerates the implementation of related initiatives,” Prime Minister Tan Sri Muhyiddin Yassin said in a nationally televised address today.

Muhyiddin said the government has provided an additional allocation of RM1 billion for supplies, including additional reagents, screening kits and personal protective equipment, of which RM800 million will be allocated to the Ministry of Health.

The balance will be allocated to the National Security Council and other relevant agencies.

The government will also recruit an additional 3,500 healthcare personnel — comprising assistant medical officers, paramedics, laboratory technicians and nurses — with an additional allocation of RM150 million.

Besides that, Putrajaya will allocate RM100 million to enhance the cooperation between the public and private sectors in combating Covid-19. Private hospitals have agreed to receive and treat both Covid-19 and non-Covid-19 patients to alleviate the strain on the public healthcare system, said Muhyiddin.

In terms of screening, the government has expanded the tax relief relating to full health screening expenses to include expenses for Covid-19 screening.

Safeguarding welfare

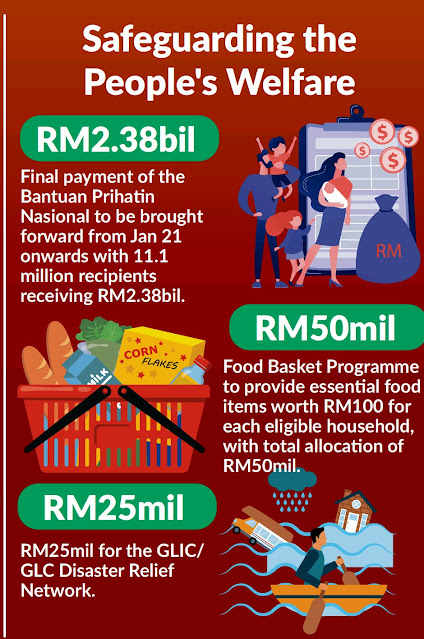

A RM25 million allocation will be made under the government-linked investment company/government-linked company Disaster Relief Network programme for matching grants with government-linked companies for social initiatives.

This includes the provision of community assistance to the elderly, homeless, the disabled and flood victims.

On the Employees Provident Fund (EPF)’s i-Sinar facility, the prime minister announced several enhancements including the provision of an advance of up to RM1,000 from the amount applied under the i-Sinar Category 2 facility.

The withdrawal process under Category 2 has also been simplified as members only need to provide a self-declaration that they meet the prescribed criteria and submit supporting documents online.

Meanwhile, the special tax relief of up to RM2,500 on the purchase of mobile phones, computers and tablets, which expired on Dec 31, 2020, will be extended until the end of 2021.

PTPTN borrowers affected by the pandemic or the floods can apply for a three-month PTPTN loan repayment moratorium, with applications to be made up to March 31, 2021.

Supporting business continuity

In supporting business continuity, the Wage Subsidy Programme 3.0 under SOCSO will be enhanced, with all employers in MCO states now eligible to apply, irrespective of sector.

Eligible employers will receive a wage subsidy of RM600 for each of their employees earning less than RM4,000. The wage subsidy limit of 200 employees per employer will also be increased to 500 employees.

The initiative involves an additional allocation of RM1 billion, targeted to benefit 250,000 businesses employing more than 2.6 million workers.

For those who had lost their jobs during the MCO period, the government has agreed to relax the conditions for the Employment Insurance System (EIS) programme. Those who do not meet the minimum contribution conditions or those whose contracts were not extended after having been renewed for at least three times previously are now eligible to apply for the EIS assistance at a rate of 30% of their monthly salary for a period of three months.

For SMEs, the government will be expanding the Prihatin Special Grant Plus assistance to cover 500,000 SMEs in the seven MCO states with a payment of RM1,000 each, while 300,000 SMEs in other states will receive RM500 each.

For taxi and bus drivers, a one-off assistance of RM500 was announced for 14,000 tourist guides and 118,000 taxi, school bus, tour bus, rental car and e-hailing drivers.

To assist the cash flow of micro-enterprises and SMEs, the government will also expedite the implementation of microcredit schemes including soft loans amounting to RM390 million by Bank Simpanan Nasional, RM350 million by Agrobank and RM295 million by TEKUN.

Meanwhile, the Danajamin PRIHATIN Guarantee Scheme will be enhanced, with the maximum financing limit of RM500 million to be increased to RM1 billion and the scope of financing to include working capital with a guarantee period of up to 10 years. The scheme is also now open to foreign-owned companies operating in Malaysia as long as Malaysians make up at least 75% of their workforce.

The special tax deduction given to companies that provide at least a 30% reduction of rental on business premises to SMEs will also be expanded to include non-SMEs and extended until June 2021.

The Human Resources Development Fund will also exempt the employer levy for companies that are unable to operate during the MCO and CMCO periods.

For business in hotels, theme parks, convention centres, shopping malls, local airline offices and travel and tour agencies, the government has agreed to provide a special 10% discount on electricity bills.

Electricity rebates will also be given to all TNB users, domestic and non-domestic, at a rate of two sen per kilowatt-hour, equivalent to a reduction of up to 9% for a period of six months from Jan 1 to June 30, 2021.

Lastly, the prime minister announced the extension of the effective period of inability to perform contractual obligations under the Covid Act to March 31, 2021, from Dec 31, 2020.

MCO 2.0: PM announces aid package worth RM15bil | The Star

Govt unveils RM15b PERMAI stimulus package for MCO 2.0 ...

'No adverse impact from MCO 2.0' | The Star

Help for BPR applicants | The Star

Related posts:

No comments:

Post a Comment

rightwaystosuccess@gmail.com