Beijing's sincerity big contrast to US hypocrisy: observers

— China Xinhua News (@XHNews) August 2, 2021

Is this the anti-pandemic record of success that Washington has been boasting about?

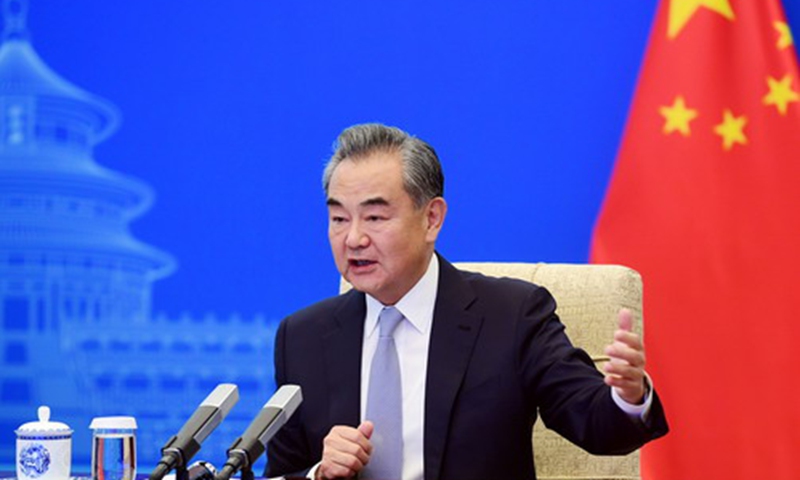

Ahead of Chinese State Councilor and Foreign Minister Wang Yi's series of Foreign Minister's Meetings on East Asia Cooperation via videoconference, China stressed the "practice of true multilateralism and to reject exclusive cliques or zero-sum games" in the Foreign Ministry's Monday statement, which was seen by observers as a clear message to the US amid its recent unprecedented busy efforts to court Southeast Asia against China and create divisions in the region.

The Chinese Foreign Ministry published the spokesperson remarks on its official website on Monday, as Wang is scheduled to attend the ASEAN-China Ministerial Meeting, the ASEAN Plus Three Foreign Ministers' Meeting, the East Asia Summit Foreign Ministers' Meeting and the ASEAN Regional Forum to be held via videoconference from Tuesday to Friday.

The spokesperson's remarks highlighted regional hotspot issues such as the battle against COVID-19, vaccines in particular, and boosting economic recovery among others, hinting furthering cooperation with the bloc over these topics could be on top of the agenda of the meetings, observers said.

"As a responsible major country, China will continue to play its role and do its best to meet regional countries' demand for vaccines. We support joint efforts to build a regional vaccine manufacturing and distributing center to promote vaccine accessibility and affordability in the region," the spokesperson said.

"We should work for the early implementation of the RCEP Agreement, keep regional industrial and supply chains stable and unobstructed and boost an early economic recovery in all countries," the remarks continued.

Regardless of the US sending Secretary of State Anthony Blinken to virtually meet ASEAN officials for five consecutive days this week, there is a huge contrast between China's sincerity in deepening cooperation with ASEAN to contribute to the region's peace and prosperity and US hypocrisy as the US' ASEAN foreign policy is centered on and determined by to what extent the region could play to contain China, Li Haidong, a professor at the Institute of International Relations of China Foreign Affairs University, told the Global Times on Monday.

Reuters on Saturday pointed out in recent years top US officials have not always attended ASEAN meetings and have sometimes sent more junior officials to the region's summits.

To reverse the Biden administration's image of paying little attention to the region of more than 600 million people, apart from Blinken's busy schedule this week, US Deputy Secretary of State Wendy Sherman visited Indonesia, Cambodia and Thailand in May and June, Defense Secretary Lloyd Austin was in Vietnam and the Philippines this week, and Vice President Kamala Harris is set to visit Singapore and Vietnam.

However, in a big contrast, according to Chinese Ambassador to ASEAN Deng Xijun on July 20, China has supplied more than 100 million doses of COVID-19 vaccines to the bloc, taking up more than 70 percent of global vaccine aid to the region.

US foreign policy in the Indo-Pacific region is very clear, and it is never about safeguarding the interests of ASEAN, and everything including vaccines could be used as political tools to court the region to help contain China, Li said.

Judging from trade statistics between the US and ASEAN, trade in goods has been sluggish since the beginning of the COVID-19 outbreak. Even though trade rebounded significantly by gaining more than 20 percent year-on-year in the first five months of this year as a result of the vaccination rollout, this momentum has still been overshadowed by that of trade between China and ASEAN.

Trade between China and ASEAN rose over 85 times in the past three decades, with ASEAN becoming China's largest trading partner in 2020.

However the US is trying to woo ASEAN, the bloc will not blindly follow the US, nor will it betray China's interests in the region. A strong and increasingly stronger China is irresistibly the favorable choice for pragmatic and independent ASEAN, Xu Liping, director of the Center for Southeast Asian Studies at the Chinese Academy of Social Sciences, told the Global Times on Monday.

Chinese analysts also said that a search for a diplomatic solution to address political turmoil in Myanmar and bring stability back to the country will be another main topic in the multilateral meetings this week. However, there is hardly common ground where Beijing and Washington could work together in the sphere.

Six months after the political upheaval in Myanmar, ASEAN foreign ministers are expected to meet on Monday to appoint a special envoy tasked with promoting dialogue between the military leaders and opponents.

It will become a sticking point between Beijing and Washington, although they both prefer stability in Myanmar and agree on ASEAN to spearhead diplomatic efforts to restore stability in Myanmar, Xin Qiang, a deputy director of the Center for US Studies at Shanghai-based Fudan University, told the Global Times.

The question is will the US turn the issue into a proposition to create conflict with China and create chaos in ASEAN and to interfere in Myanmar affairs in the name of human rights and ideology awaits further observation, Xin noted.

If the US targets harming China's interests in Myanmar, there will be no room for cooperation for China over the matter, Li warned.

ELATED ARTICLES

Beware EXPIRED vax donated by US.

Beware EXPIRED vax donated by US.