Share This

Thursday, 6 December 2012

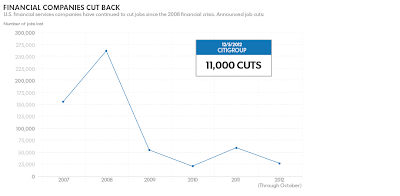

Citigroup to sack more than 11,000 jobs

NEW YORK — Citigroup's move to sack more than 11,000 workers may foreshadow bigger cuts as its newly installed chief executive shakes up the lumbering Wall Street behemoth.

The New York bank's restructuring — coupled with a $1-billion write-down in the fourth quarter — came as Citi, like other financial giants, suffers through a hangover from the housing meltdown and struggles to adjust to the resulting regulations.

"This is simply just the beginning," said Todd Hagerman, an analyst at Sterne Agee. Restructuring on Wall Street, as firms prune non-core businesses, is "going to be fairly painful over the next several years."

A $1-billion charge might otherwise throw cold water on a company's stock. But investors clearly approved of Citi's restructuring, which came sooner than analysts expected — only seven weeks into Michael Corbat's tenure as CEO. Citi stock jumped $2.17, or 6.3%, closing Wednesday at $36.46.

Corbat took Citi's helm after Vikram Pandit's abrupt departure from the CEO suite in October, following a long-simmering dispute with the bank's board of directors. Analysts saw Citi's layoffs as a much-needed first step, though not enough to satisfy restive investors.

"We view this move as an initial 'tremor,' and that an 'earthquake' or more radical restructuring is needed before the April 16th annual meeting to satisfy activists," Mike Mayo, a banking analyst with CLSA, wrote in a note. "While clearly a portion of these moves must have already been in the works, the moves today create a tone that the new CEO will not take half-measures."

Big Wall Street banks have been shrinking their payrolls to maintain profits in the wake of the financial crisis and sweeping new regulations aimed at reducing risk.

As of Sept. 30, Bank of America's head count had fallen 6% from the previous year to 272,600, regulatory filings show. Morgan Stanley's payroll was down 7% to 57,726, and Goldman Sachs' payroll had fallen 5% to 32,600 over the same period.

Citi's more than 11,000 job cuts account for 4% of its global workforce of 261,000.

About 6,200 of the layoffs will come from Citi's consumer banking operations in the U.S. and around the world as the company focuses on 150 cities with the "highest growth potential," the bank said. Other cuts include 1,900 jobs in its group serving institutional clients.

The cuts include closures of 44 U.S. consumer banking branches.

Four California branches will close Dec. 14. Affected customers have been notified of the closures in North Hollywood, Santa Rosa, Fresno and at John Wayne Airport, a spokeswoman said. FDIC records show 382 of Citibank's 1,060 U.S. offices are in California, the most of any state.

"These actions are logical next steps in Citi's transformation," Corbat said in a statement. "While we are committed to — and our strategy continues to leverage — our unparalleled global network and footprint, we have identified areas and products where our scale does not provide for meaningful returns."

In addition to the U.S. branches, Citigroup will close 14 in Brazil, seven in Hong Kong, 15 in South Korea and four in Hungary. The company also said it expected to "sell or significantly scale back" its consumer banking operations in Pakistan, Paraguay, Romania, Turkey and Uruguay.

Citi said the cuts would save $900 million in 2013 and produce $1.1 billion in annual savings in 2014 and beyond.

Although the bank said it would book a $1-billion pre-tax charge in the fourth quarter, along with $100 million in related charges in the first half of 2013, Citi said the restructuring would reduce annual revenue by less than $300 million.

"That just tells you how poorly this company has been under-performing in a number of different areas over the last several years," Hagerman said. - AP/LA Times/Reuters/USA Today

Related post:

US Fiscal Cliff poses threat to economy worldwide! 21 Nov 2012

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment

rightwaystosuccess@gmail.com