KSK Group Bhd chairman Tan Sri Kua Sian Kooi with daughter Joanne who is KSK CEO & KSK Land Sdn Bhd MD

Flexibility: 8 Conlay units have the flexibility that allows residents to live their story the way they desire.

Fresh from announcing that its branded residence for Tower A at 8 Conlay project will be sold at a record RM3,200 per sq ft, Kempinski Hotel Kuala Lumpur has now been recognised under the Government’s Economic Transformation Programme.

IF 8 Conlay’s RM3,200 per sq ft (psf)selling price has set tongues wagging for possibly setting a new pricing record in luxury living, here is another development to add to the several “firsts” the project has notched since it was announced some two-and-a-half years ago.

Kempinski Hotel Kuala Lumpur, which is a component of 8 Conlay, has been recognised as an entry point project under the Tourism National Key Economic Area (NKEA) of the ETP - the Government’s initiative to propel the economy into high-income status by 2020.

Kempinski Hotels, Europe’s oldest luxury hotelier, is the hospitality partner of 8 Conlay’s owner and property developer KSK Land Sdn Bhd.

The hotelier will provide services for the project’s branded residence towers as well as manage the hotel tower.

“We got it (the endorsement) recently,” declares a proud Joanne Kua, who is the managing director of KSK Land.

According to the 30-year-old, the recognition is a sign of “quality assurance” that will place 8 Conlay on the global map.

“Even though we are in the ETP because of Kempinski Hotel Kuala Lumpur, Kempinski is also servicing our branded residence.

“This means there is a level of service that we need to adhere to for the entire development. This has always been what we have been reiterating at KSK Land, where every development we undertake has to be of good quality, and the service we provide to customers is always on top of our minds,” Joanne tells StarBizWeek.

“Being the owner of Kempinski Hotel Kuala Lumpur, we are proud to be pushing the boundaries by bringing the Kempinski brand into the Malaysian market because we are one of the few - if not only - fully integrated branded residence developments in the KLCC area.”

Kempinski Hotel Kuala Lumpur is slated to open its doors in 2020, coinciding incidentally with the planned “Visit Malaysia Year” in that same year.

In terms of numbers, Kempinski Hotel Kuala Lumpur is projected to bring in RM19.8mil in gross national income or GNI in the year 2020, which is expected to grow in the following years. Job-wise, the hotel is expected to create some 780 employment opportunities when it opens its doors in January 2020, while committed private investments amount to RM360mil, shares Joanne. This RM360mil is the cost of developing the hotel minus the land cost.

Shedding more light on the ETP recognition, the KSK Group director for corporate strategy and investments Pankaj C Kumar says that these numbers have been audited by the panel of auditors at the Performance Management and Delivery Unit or Pemandu, the driver of the ETP initiative.

“We started engaging with them early last year. Under the ETP’s Tourism NKEA, the Government’s plan is to increase the number of four- and five-star hotels, as well as increase the room rate in Malaysia, which is still relatively lower as compared to the region. They also want to create more vibrancy within the KLCC and Bukit Bintang areas,” says Pankaj.

Kempinski Hotels chief executive officer (CEO) Alejandro Bernabé says the ETP recognition raises the profile of its upcoming hotel in Kuala Lumpur. “For us, this creates even bigger expectations not from the construction point of view, but from the deliverance of (service) expectations. With the opening of the hotel in 2020 coinciding with a planned Visit Malaysia Year, we have to ensure we get it right from day one, as we cannot afford to let the honour of the country down,” he says in the joint interview. Bernabé was in town for the launch of 8 Conlay’s signature sales gallery on Wednesday. During the launch, phase one of 8 Conlay’s branded residence units known as YOO8, serviced by Kempinski, was officially open for sale. A private viewing for a select few of around 200 comprising the who’s who of the corporate circle was held on the same evening of the launch.

With piling works having begun at the four-acre site, it seems to be all systems go despite the expected slowdown seen in the property sector by analysts.

And in what is seen as a “coup of sorts” in positioning and differentiating 8 Conlay, the company has teamed up with the crème de la crème of brand partners like internationally-celebrated design company YOO, local architect Ar Hud Bakar and Bangkok-based landscape design firm TROP other than the world-class hotel management services of Kempinski.

8 Conlay unveiled

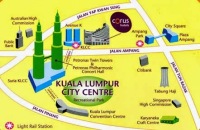

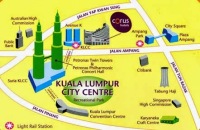

8 Conlay owes its name to the auspicious address it sits on in Kuala Lumpur’s Golden Triangle. The development comprises of two YOO-interior designed branded residence towers of 57- and 62-storey blocks that will be connected via two sky bridges on levels 26 and 44. The development is complemented by a 68-storey five-star Kempinski Hotel, serviced suites and a lifestyle retail component.

YOO8 comprises two spectacular towers of 1,062 luxury branded residence, ranging from one to three-bedroom units.

Tower A of YOO8 will feature 564 units covering 700 square feet to 1,308 square feet selling at an average price of a whopping RM3,200 psf.

According to the company, 70% of Tower A has been reserved, with 80% comprising Malaysians.

Meanwhile, Tower B of YOO8 will feature 468 units to be launched some time next year.

Can 8 Conlay usher KSK into the competitive world of property?

8 Conlay’s selling price of RM3.200 psf, which is RM500 psf higher than the indicative RM2,700 psf it was only recently looking at, begs the question of whether it can sell in a soft market. Being the maiden venture for KSK Land, all eyes are on the company and its young and petite head honcho, Joanne. After all, 8 Conlay’s entry into the branded residence space is coming after a hiatus of similar launches in the city.

Joanne: ‘Price is reflection of interest.’

KSK Land is the property arm of KSK Group Bhd, which has insurance as its other core business. KSK Group was formerly known as Kurnia Asia Bhd that was privatised in 2013.

Joanne, who is also KSK Group’s CEO, is the daughter of the 62-year-old KSK patriarch and executive chairman Tan Sri Kua Sian Kooi.

While Joanne is playing a bigger role as the face of property in the KSK stable, it is no secret that senior Kua remains the driving force of the group.

KSK had sold its Malaysian insurance business in 2013 and diversified into property in the same year. It still operates insurance businesses in Thailand and Indonesia.

A quick check with property consultants indicate that the Banyan Tree branded residence is being transacted at prices between RM2,500 and RM3,000 psf, while St Regis was approaching the RM3,000 psf mark as at July estimates.

As for Four Season’s Place, a property consultant puts the going figure between RM3,000 and RM3,500 psf. “At RM3,200 psf, 8 Conlay is trying to position itself in the likes of Four Seasons. However, Four Seasons sold its units much earlier and it would be interesting to see if 8 Conlay is able to match Four Seasons, given the current market situation,” says the property consultant.

Joanne, however, remains optimistic that 8 Conlay would do well and prove the sceptics wrong.

“The price is a reflection of interest coming from the market. At the same time, if you were to compare what’s around the KLCC area, the pricing will justify the product.

“In terms of value, our location on Jalan Conlay is a strong point as in the branded residence market, buyers buy for location, which itself is capital preservation,” she says, pointing out that branded residences command a 30% higher value than luxury apartments based on a recent Knight Frank report.

Bernabé: ‘Kempinski Hotel Kuala Lumpur in the ETP raises the hotel’s profile.’

The disproportion between local and foreign buyers is due to the lack of marketing so far. “With the launch of the sales gallery, we are only now officially going out to market. We are eyeing all major cities like Singapore, Shanghai, Beijing, Taipei, Korea, Hong Kong, Japan and the Middle East.”

The project is eyeing an equal spread of local and foreign buyers.

Locally, she shares that interest has been coming from surprisingly “young professionals who are well-travelled and know of Kempinski”.

“A branded residence is something one buys for capital appreciation for the long term. The buyers are a discerning lot and yearn to have a certain lifestyle.”

In terms of benchmarking, Joanne says that 8 Conlay is being benchmarked with other similar branded residences around the world and that prices in Malaysia are still relatively on the low side.

“If you look at branded residences in London, they are really about infusing three components. One is a five-star luxury service provider which you cannot deviate from. The second is the design element. When you partner a good name for design, buyers feel “safe” knowing that what is to be given is of a certain quality and level.

“The third is the architecture component, which often tends to be overlooked. But people who buy a branded residence are discerning buyers who look for offerings that are limited and unique.”

A unique proposition

Joanne describes it as providing a seamless experience for buyers all the way from the outside to the inside.

“When the thought process began to develop 8 Conlay, we looked at the branded residence space around the world and asked ourselves what was really available here. This is when we decided that we had to differentiate ourselves from the rest and would be able to do it,“ says Joanne.

This in essence sealed the company’s partnership with Kempinski. “What is unique about Kempinski is that in every hotel in the different cities it operates, there is a combination of its heritage and the owner’s identity, which I think is a strength many hoteliers don’t have. That’s one of the reasons why we like Kempinski because of the flexibility that allows for both parties’ personalities to stand out. That makes a very good hotel,” says Joanne.

She shares that the affinity to Kempinski is not altogether a new idea to KSK.

“The (Kua) family has had experience with staying at different Kempinski Hotels as we travelled a lot. So, when we were looking to partner a hotelier, Kempinski naturally popped into our chairman’s mind fairly quickly,” she says.

At the same time, Kempinski was also scouting for opportunities in Kuala Lumpur as part of its expansion into this part of the region.

Water theme: A unit designed around the ‘water’ element. Upon entering, one is treated to the magnificent view of KL City Centre beyond the foldable doors.

“Kempinski is quite exclusive. We choose our projects very carefully and make sure we work with partners that share the same common values.

“We are looking for exclusivity and authenticity and benchmark ourselves with the top residences in the world because customers who buy these residences have choices being well-travelled,” adds Kempinski’s Bernabé.

He reckons that having other branded hotel residences around 8 Conlay is not competition, but rather a good thing for the person who lives there because “if you live in a branded residence, you would want your neighbourhood to be of the same calibre”.

Drawing strength from brand partners

Joanne says 8 Conlay’s strength is the diversity of the international brand partners it has teamed up with, which would serve as an advantage as it markets overseas.

“Tower A is designed by Steve Leung and YOO. Steve Leung is akin to the “Andy Lau of design” in Hong Kong and China, while Kempinski has a strong presence in the Middle East and China,” says Joanne.

“For interior design, we have YOO which is not new to the branded residence segment. It knows what it means to take on the little details that people don’t see in space optimisation. This is why we market our residence fully furnished because that is the strength we want to show in one of our brand partners.

“And as far as the Kempinski name for service is concerned, you can only experience it if you have stayed in one of the Kempinski Hotels and understand the service standard it brings to the table.”

Incidentally, for Kempinski, YOO, Steve Leung and TROP, this is their first time in Malaysia. “The good thing about this is that it gives us a fresh pair of eyes, where we can innovate and do something different.”

Joanne says the company is also not strategising to compete with other players for its retail component. “In fact, we like it that Pavilion is close to us because it provides options for our buyers.

“We are not building a mall, we’re building a retail lifestyle quarter. We are going with the design first, as it needs to complement the whole development and be an attractive point on its own,” she says.

Taking a leaf out of its insurance book

Joanne believes that 8 Conlay’s unique concept will pan out as planned.

“When we conceptualised the project, our chairman Tan Sri Kua made it clear that he wanted to grow into a conglomerate. It’s not that we woke up one morning and decided that we wanted to go into property. The root of our business is in insurance, which is a long-gestation project. There is no denying that property is also for the long term, so there is no right or wrong time to go into this business.

“In insurance, we come from a base where it is all about customer service. So, when looking at property, we also looked at it from a completely different angle ... we put ourselves in the customer’s shoes and decided what we could do differently.

“When we decided which direction we wanted to go into in property, the message was very clear - to make sure we added value to the customer.”

“Creating extraordinary living spaces is what we do. KSK Land is formed on this philosophy and our job here is to create something extraordinary for 8 Conlay.”

On her taking on a mammoth project at a relatively young age, Joanne says she does not see her role from a gender perspective. “Any CEO would face the same challenges as me. The important thing is mutual respect, and in KSK, we are a family. We work together and celebrate together.”

By Gurmeet Kaur The Starbiz

Related posts

Related posts:

13 Apr 2014

New kid on the block: Singapore's 'shoebox king' Oxley spices up Kuala Lumpur a record RM3,300 per sq ft. IN just 10 months, Singapore-listed Oxley Holdings Ltd has quietly amassed a gross development value (GDV) of ...