Quora

https://www.quora.com

What are the US demands for Chinese government to accomplish in order for the US to list China as a friendly nation?

There are things American politicians will say and wrap them as highly noble, but are actually destructive and dangerous. Here are some examples you can hear from any “well intentioned” American politician. Statement no.1: “We want China to become a fully democratic society with a vibrant political life.” Reality: “We want China to become a toxic, polarized and unstable society where even simple state decisions will be next to impossible to make because of corrupted political parties representing only their own interests, not the national ones. We’ll also be able to influence those parties through our “democracy development funds” and ensure that there’s always enough polarization to prevent any serious economic and infrastructure development.” Statement no.2: “We want China to give Taiwan, Hong Kong, Tibet, Inner Mongolia and all provinces freedom of self determination and let them grow civil rights organizations and political parties that will promote new, democratic values.” Reality: “We want China to fall apart to many smaller regions and provinces that will be easy for us to control through advocating and financing organizations that promote separatism and anti-China policies - look, some people in HK and Taiwan already claim they’re not Chinese! If Islamic terrorism starts happening again in Xinjiang, we’ll call those terrorists fighters for freedom. If some rioters in Hong Kong burn cars, loot shops and attack anyone who speaks Mandarin, we’ll call them young fighters for democracy.” Statement no.3: “We want China to allow full media freedom” Reality: “We want China to allow our media companies to enter the market and promote destructive values through publishing lies or skewed facts that show that the government is the enemy of the people. We will promote the destruction of the current political and social system and then claim that we’re fighting for freedom and democracy. We will accuse everyone saying anything good about the current government even when it’s true to be an anti-democratic piece of scum. If the society in China implodes as a result this anti-national propaganda - pity, you cannot have democracy and freedom without victims” Statement no.4: “We want China to open its economy to equal treatment of American businesses and investments” Reality: “We want China to sell all their valuable companies to us and let us enter the strategic national industries we would never allow Chinese companies enter in the US. The fact that many American companies do business in and with China is not good enough for us - we want to be able to own the strategic industries in China. At the same time, we’ll ensure that no Chinese companies buy anything truly valuable in the US under the guise of protecting the American national interests, which is a great trump (!) card no one will ever dispute.”Statement no.5: “We want China to stop government subsidies and allow a fair market competition.”

Reality: “We want China to stop investing in development of industries that can compete with ours and just buy our products. Even then, if a Chinese company has any potential to succeed in the US, we will make sure that through corporate lobbying and merciless anti-China campaigns any chance of success is nipped at the bud. We’re all for free markets, but only when it works for our companies.”

Answer: Nothing can be done. The US at this moment wants to see China weak, poor and destroyed. A strong, developed China with a competitive economy and global Chinese brands is something the US will never accept.

Related:

Aggressiveness of US democracy derived from hegemony ...

World has long been unwilling to be deluded by US-style democracy: Global Times editorial

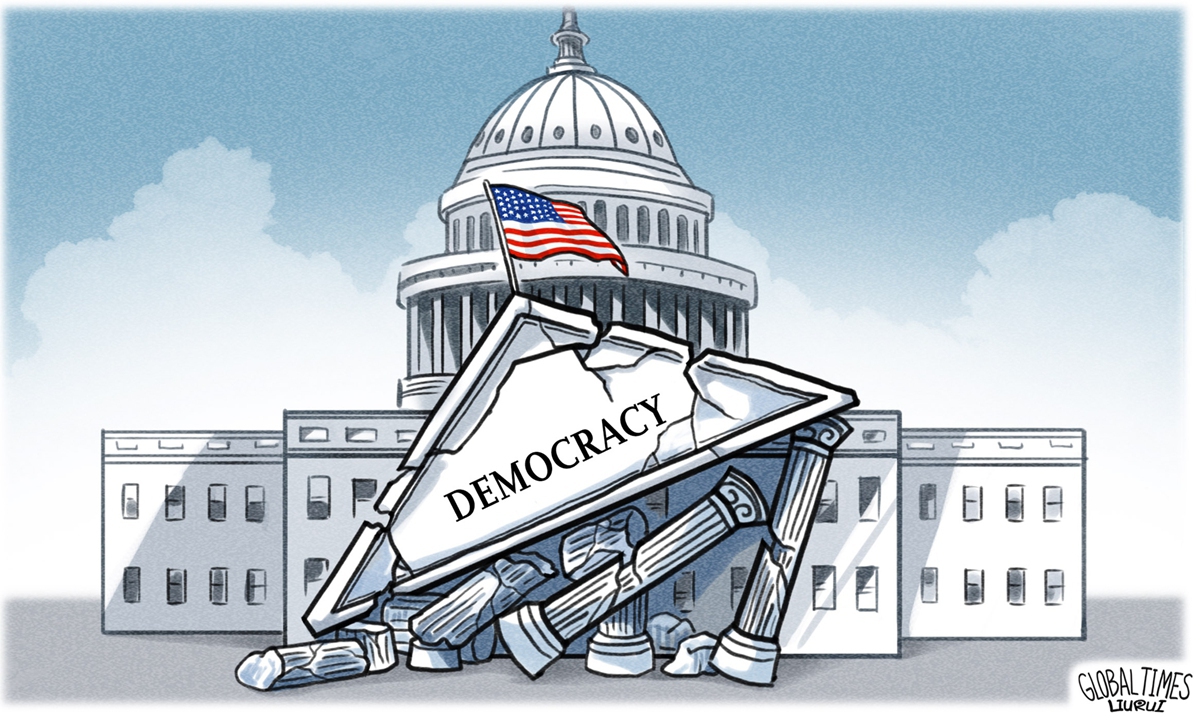

"US-style democracy," which has long been used by the US as a weapon to instigate conflicts, has increasingly incurred alarm in the world, while the banner of ideology can no longer hide the true color of hegemony, bullying and high-handedness.

US is like 'a mafia boss in his later years': expert at GT annual conference

US public opinion is controlled by political and public opinion elites

Quake Delivers Earth-Shattering Blow to U.S.-Led NATO Hypocrisy

Very good and truthful article

https://geopolitics.co/2023/02/10/quake-delivers-earth-shattering-blow-to-u-s-led-nato-hypocrisy/

This is a speech of highly applaudable !!!

US contains China