According to the World Bank, businesses and individuals pay over US$1 trillion (RM4.2 trillion) in bribes each year.

Corruption adds up to 10% of the total cost of doing business globally and up to 25% of the cost of procurement contracts in developing countries.

I gathered these shocking facts at a conference. There are other alarming statistics that shed light on the damage brought about by corruption and its dreadful impact on the economy.

Corruption leads to further impoverishment of the poor and other issues in many countries. The average income in countries with a high level of corruption is about one-third of those countries with a low level of corruption. In addition, corrupt countries have a literacy rate that is 25% lower.

The Corruption Perception Index 2018 released by Transparency International shows that on the scale of 0 to 100, where 0 is highly corrupt and 100 is very clean, over two-thirds of 180 countries score below 50, with the average score of 43.

In the index, Denmark ranked first in the world followed by New Zealand second. Finland and Singapore were tied for third with a score of 85. Malaysia was ranked 61st in the world, scoring only 47.

We were ranked the third highest in the Asean region, after Singapore and Brunei. Our country is doing better now with the ongoing investigation of the 1Malaysia Development Bhd scandal and other prominent cases.

In TI’s report, Malaysia is one of the countries on the watch with promising political developments against corruption. However, more solid action is needed in combatting all elusive forms of corruption.

According to Transparency International Malaysia, corruption had cost our country about 4% of its GDP value each year since 2013. Added together, this amounts to a high figure of some RM212.3bil since 2013. For 2017 alone, that figure was a whopping RM46.9bil!

As a comparison, our development expenditure in 2017 was RM48bil. If the value of corruption above was accurate, our development fund was almost “wiped out” because of corruption.

Transparency International Malaysia president Datuk Akhbar Satar said: “This is our estimate. It is likely to be higher in reality (on the value of corruption).”

No country can eliminate corruption completely. However, we can learn from good practices shown in some developed countries, such as the Scandinavian countries which all scored high on the Corruption Perception Index.

Corruption leads to poverty as money collected is not used for the welfare of the nation. As a result, the people end up suffering and paying for the leakage in the system.

If a country is corrupt-free, it will reduce the need for non-governmental organisations (NGOs). NGOs advocate for the rights of marginalised groups. The government can take care of those group when it has a surplus in the budget.

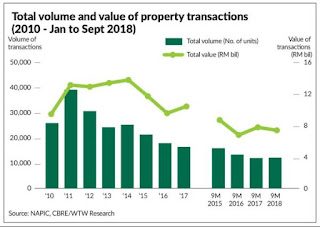

A clean government and system will have a positive impact on many aspects including affordable housing, one of the prominent needs of the people.

Whenever there is corruption, there is a compromise in the delivery of goods and services. The same situation applies to affordable housing.

Someone mentioned to me in the past that “the government isn’t interested in affordable housing as there is literally ‘no money’ to be made in it”!

Things have made a dramatic change for the better since May last year. Our new government is working on a platform of clean government and improving transparency. It plans to build one million affordable homes within two terms of its administration. To make this a reality, the government needs to put in real money to make it happen.

Corruption causes a death spiral that leads to various problems. Without it, a virtuous cycle grows that ensures every part runs smoothly and the marginalised in society are looked after.

With a promise of a cleaner government, we hope we will soon see a virtuous cycle that makes the one million affordable homes an achievable target.

By Datuk Alan Tong, who has over 50 years of experience in property development. He is group chairman of Bukit Kiara Properties. For feedback, please email bkp@bukitkiara.com. The views expressed here are solely that of his own.

Source link

Singapore's decade-low growth triggers recession warning - Business .

Related posts: